Former NFL Pro Bowler and Carolina Panthers franchise great Mike Rucker has sued former his former investment adviser, claiming that he and his family lost nearly $3 million after their money was unknowingly mismanaged and invested into a Ponzi scheme. According to the Charlotte Observer, the lawsuit was filed by the Ruckers in March against Jon Kubler, who had managed the family’s money for 21 years.

In 2023, the Securities and Exchange Commission notified the Ruckers that Kubler had been accused of running a commercial real estate Ponzi scheme, with his companies having raised approximately $5.6 million in investor funds only to invest just 4% of that money. The SEC claimed that Kubler had used investor’s money to make Ponzi-like payments to earlier investors as well as for personal use. Kubler was indicted by the Justice Department last month on charges of securities fraud and money laundering.

According to the Rucker’s lawsuit, Kubler mismanaged the family’s real estate dealings, including a line of credit they had secured to build a house, and also took out loans under their name and their real estate business’ name in order to pay himself. They also alleged that Kubler had diverted more than $1 million of their funds, forged their signatures to open accounts in their names and company names, and caused the family significant financial loss when he convinced Mrs. Rucker to take out a $14 million life insurance policy that generated fees and commission that Kubler paid to himself as the placing agent.

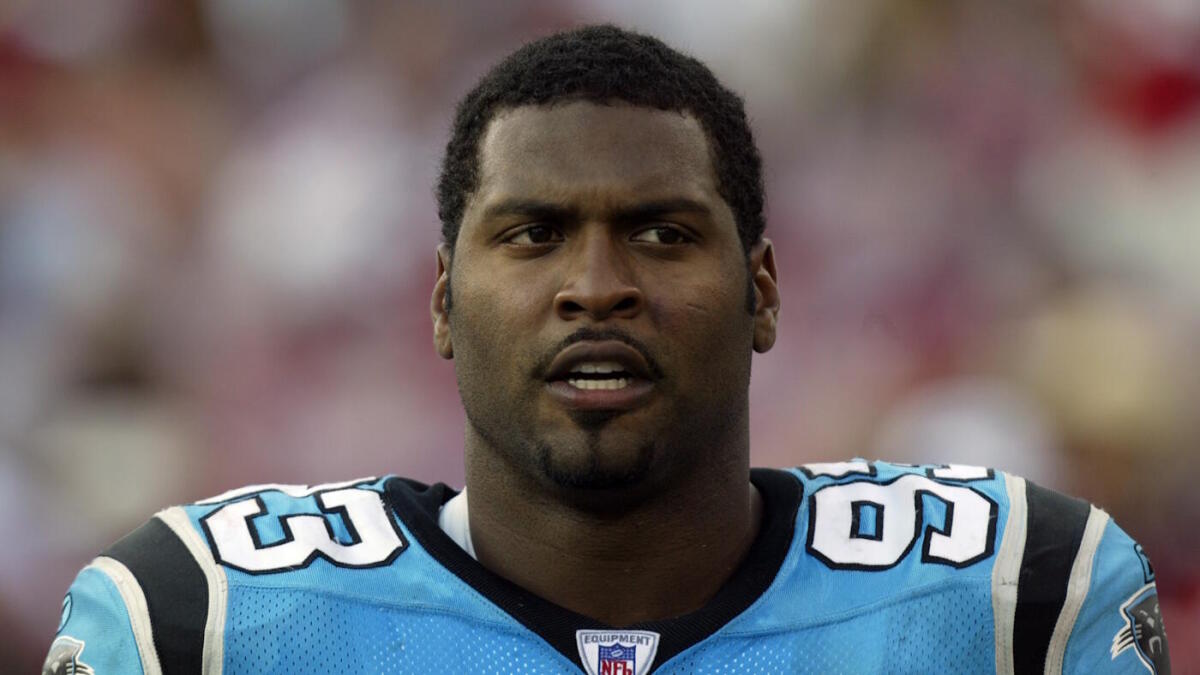

Rucker played his entire NFL career for the Carolina Panthers, affirming himself as one of the franchise’s greatest defensive linemen ever in a 2003 campaign that saw him make the Pro Bowl, earn NFL Alumni Defensive Lineman of the Year honors, and play a pivotal role on a defense that helped lead the Panthers all the way to Super Bowl XXXVIII. Rucker, who retired following the 2007 season, now owns a real estate company in Charlotte, N.C. with his wife.

Kubler reportedly settled the SEC’s claims earlier this year, agreeing to pay penalties after being accused by the Justice Department of being an unlicensed adviser running a $4 million investment scheme with Ponzi-style payments.

Go to Source

Author: Steven Taranto

July 1, 2025 | 3:20 pm